Budgeting with the NoFi Template

Ian Hansborough

10 min. read · 09/29/2023

A in-depth look at the NoFi template's budget categories and monthly summaries.

Welcome back to our NoFi tutorial series! In part 1, we got you started with setting up your NoFi account, linking your financial accounts, and navigating the basics of the NoFi template. If you haven't checked out part 1 yet, we highly recommend doing so before diving into this post. In this installment, we'll take a deep dive into budgeting with the NoFi template.

Recap

Before we begin, let's quickly recap the key checkpoints from Part 1. By now, you should have:

- Successfully set up your NoFi account.

- Configured your preferences

- Explored your NoFi account management dashboard.

- Linked your financial accounts securely through Plaid.

Now, we'll take an in-depth look at the NoFi dashboard, starting with budget categories.

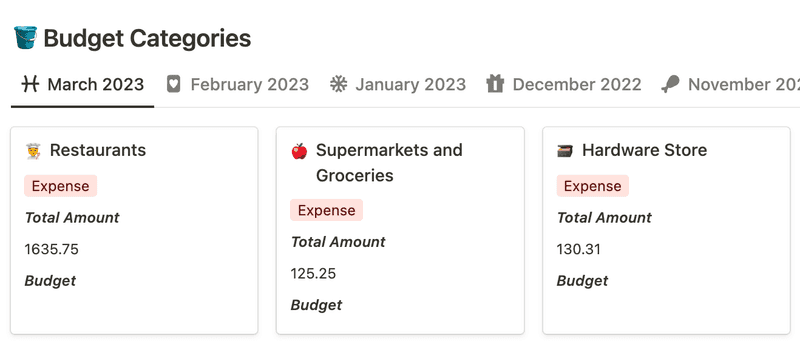

Customizing Budget Categories

The Budget Categories section is one of the most useful, yet least intuitive sections of the NoFi template. This is where you define and customize the categories for your transactions. It also, as the name suggests, gives you a comprehensive view of your budget and spending habits for a given month.

Assign Icons to Categories

NoFi provides generic icons for your budget categories by default. However, customizing these icons can make your workspace more visually appealing and add a personalized touch. Simply click on a category, like "Restaurants," and select an icon that resonates with you. Visual cues make it easier to identify categories at a glance.

Creating a New Budget Category View

NoFi provides database views for the budget category database that allow you to view you budget categories and corresponding budget amounts for a given month.

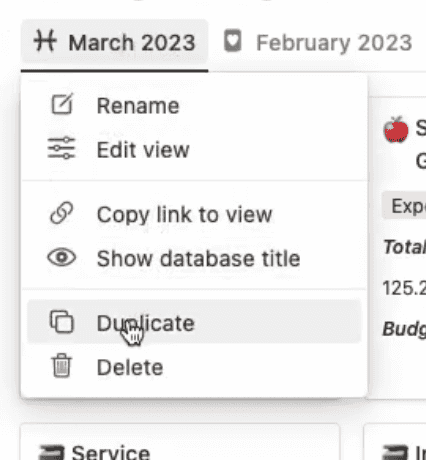

At the moment, the Notion API doesn't allow us to create these database views for you automatically 😞 (hopefully they will in the future). For now, we're at least able to populate the template with some views for past months that you can duplicate and customize for use with current/future months.

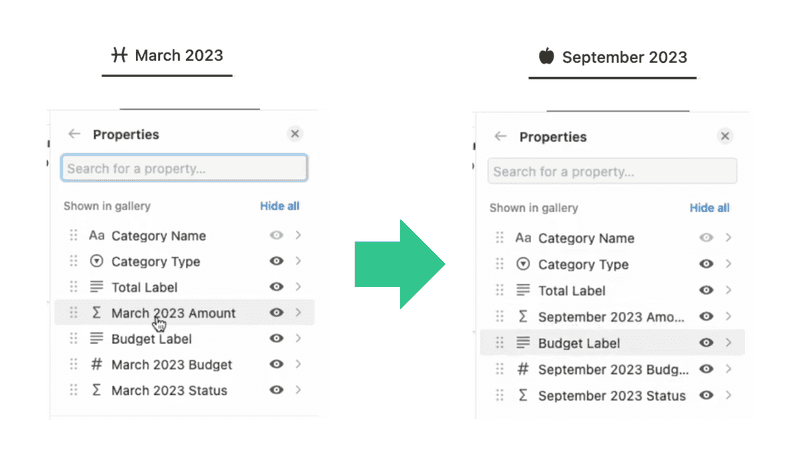

Once you've duplicated an existing budget category database view, you'll need to customize the visible properties to match month that you would like to represent. You can reference the image below for an example of what that looks like in practice. As an aside, it's worth noting that NoFi creates these properties for you on the fly. This means you likely won't see properties for future months or until NoFi syncs a transaction for that month to your workspace.

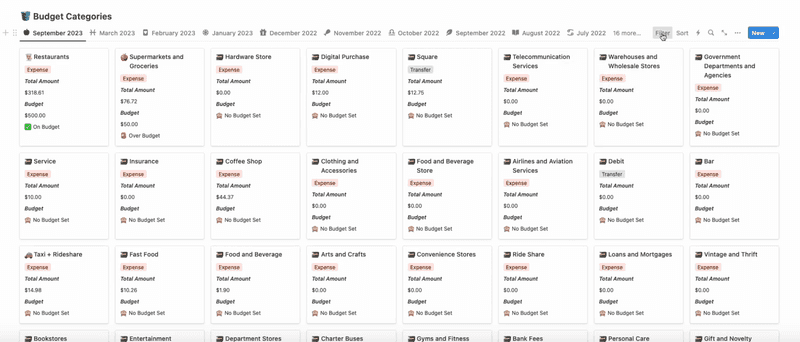

Efficiently Manage Categories

NoFi generates a budget category page for each category it encounters when importing your transaction data. If you're like me, you probably only care about tracking/using a small fraction of these categories. Moreover, having to sift through a list of 100+ categories is daunting and messy.

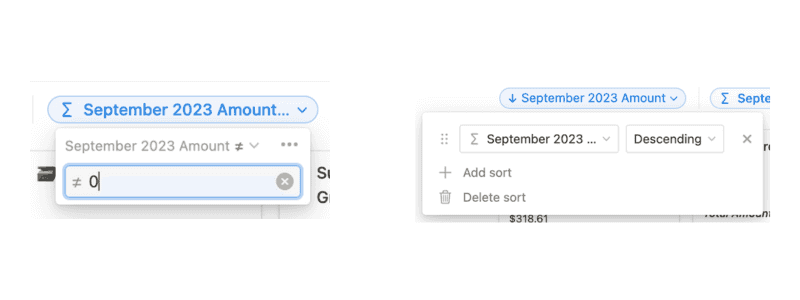

To declutter your budget categories view, It's often useful to set up a combination of filters/sorts to display only categories with non-zero amounts and sort by the monthly amount. This way, you only see budget categories that you actually spent used for a given month, and your largest categories are displayed first. See below for a screenshot showing this type of filter/sort setup.

Set Up New Budget Categories

If you wish to categorize transactions under a budget category other than the ones pre-populated by NoFi, you can do so by just creating a new page in the budget categories database for your desired custom category.

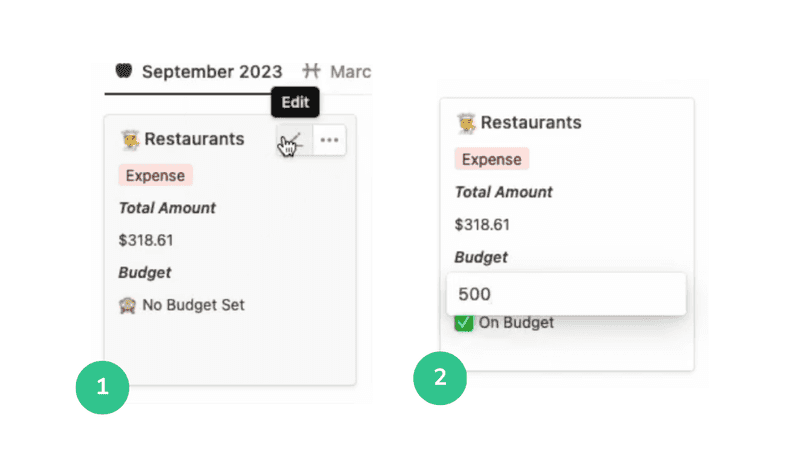

Setting a Budget

Now that we have a handle on customizing and organizing our budget categories, it's time to discuss how you actually go about setting a budget for a given category. Click on the edit icon in the upper right of a budget category, then enter your desired monthly budget amount.

Budget Status

The budget status is a formula property that displays a message based on the current status of a categories budget for a given month. Possible values are as follows.

🙈 No Budget Set: You haven't set a budget for this category.

✅ On Budget: You've met or exceeded your budget. For expenses, this means the amount is <= the budgeted amount.For income, this means the amount is >= the budgeted amount.

🚨 Over Budget: Your expenses for this category are >= the amount you budgeted.

🚨 Under Budget: Your income for this category is <= the amount you budgeted.

Category Types

Before we move on to talk about monthly summaries, it's important to dig a little deeper on budget category types. Understanding category types (income, expense, and transfer) is crucial for maintaining accurate monthly summaries.

Income: Assign this type to transactions that represent money coming into your accounts, like your salary or freelance income.

Expense: Categorize expenses, such as bills, groceries, or dining out, under this type.

Transfer: Use this type for transactions that involve moving money between accounts, like transferring funds between your checking and savings accounts, credit card payments, etc.

When categorizing your transactions, make sure the budget category you are assigning has the correct category type.

Maintaining accurate category types will ensure your monthly summaries provide accurate insights.

Monthly Summaries

The monthly summaries section provides insights into your total month-to-month expenses, income, and cash-flow. If your income/expense/balance for a given monthly summary looks incorrect, it's likely because of a category type error in one of your budget categories. Please refer to the above section for a more detailed explanation on what these category types mean and how to properly utilize them.

What's Next?

I hope you've enjoyed this in-depth look at budgeting with the NoFi template. We'll be back soon with guides to advanced template customizations, the "backend" template internals, and more!